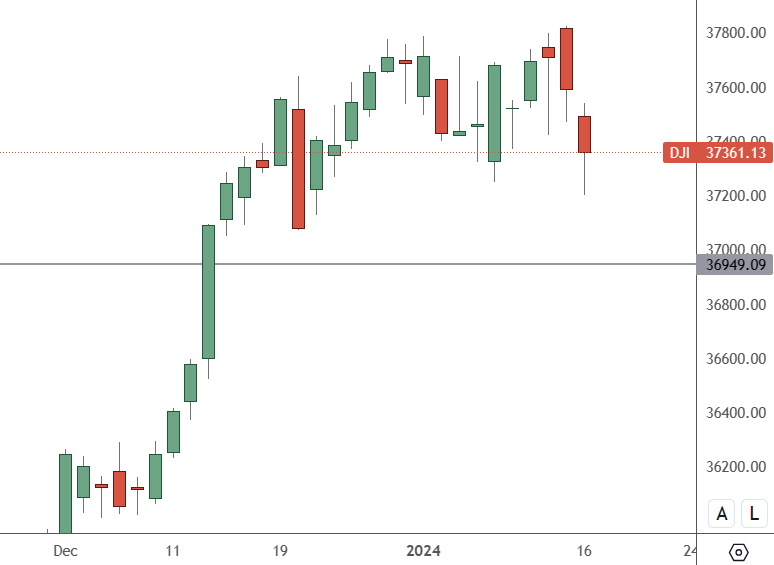

The US30 index hit new all-time highs in 2023, but that rally is under threat as the expectations for early US interest rate cuts tumble.

US30 – Weekly Chart

The US30 index reached a record high in December above 37,000 and has continued to churn higher. A pullback to test that 37,000 level is a risk for the index in the near term. But traders should watch the supports at 37,200 for a possible bounce.

Federal Reserve policymaker Chris Waller disappointed markets with his take on rate hikes this week.

“I am becoming more confident that we are within striking distance of achieving a sustainable level of 2% PCE inflation,” Waller said in prepared remarks at a virtual event hosted by the Brookings Institution on Tuesday.

“As long as inflation doesn’t rebound and stay elevated, I believe the FOMC will be able to lower the target range for the federal funds rate this year.”

But Waller reiterated his support for three cuts… not six like the market wants…

“This view is consistent with the FOMC’s economic projections in December, in which the median projection was three 25-basis-point cuts in 2024”.

And certainly does not see the need for aggressive cuts priced into the market:

“When the time is right to begin lowering rates, I believe it can and should be lowered methodically and carefully,” he said.

“With economic activity and labour markets in good shape and inflation coming down gradually to 2%, I see no reason to move as quickly or cut as rapidly as in the past.”

He reiterated that the timing of cuts and the actual number “will depend on the incoming data”, explicitly calling out the surprising strength in the December jobs report as “largely noise” against a trend of ongoing moderation. He noted that several 2023 job reports have been revised lower, and “there is a good chance December will be revised down.”

Finally, Waller made it clear that The Fed is in no hurry to act:

“I believe policy is set properly,” he said.

“It is restrictive and should continue to put downward pressure on demand to allow us to continue to see moderate inflation readings.”

That sent US rate cut odds tumbling to 60% for March, down from 80% at the start of the year, and has added some weight to the US stock indices this week.